City Budget Squeezed Between Basic Costs and State Neglect

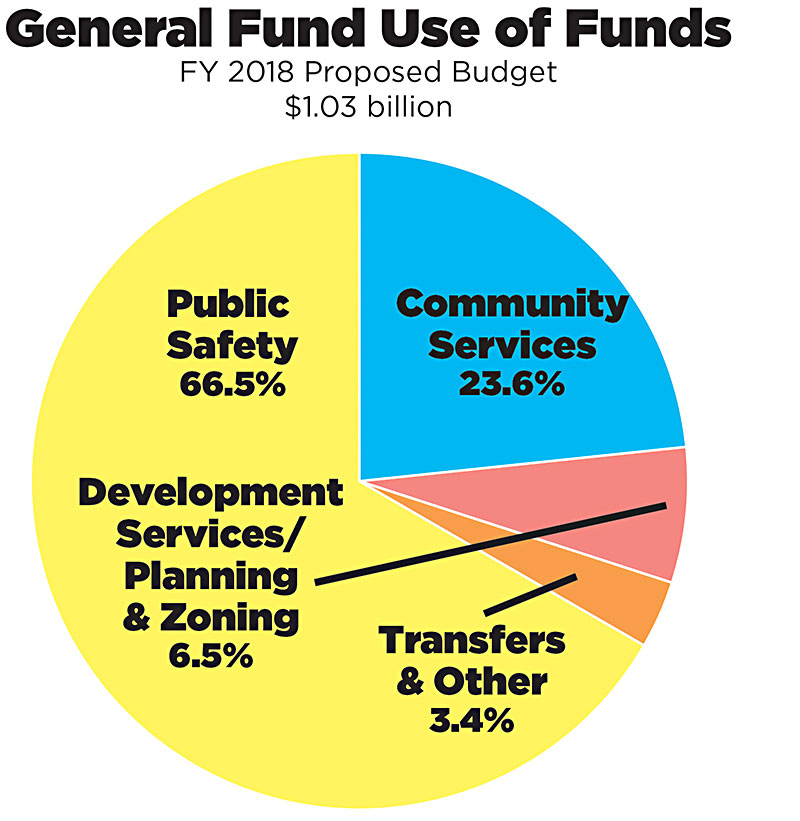

The city has $1.03 billion in taxpayer money. Here's where it's going.

By Michael King, Fri., Aug. 11, 2017

Last week's city budget presentation began in tears – those of interim City Manager Elaine Hart, who choked up as she thanked her budget staff for their hard work in preparing her proposed fiscal year 2018 budget. "Budget staff, you know I love you," she told Budget Officer Ed Van Eenoo, then turned to Council. "They work their hearts out for you guys." That might have been the emotional highlight – until a couple of hours later, when Mayor Steve Adler and Council Member Ellen Troxclair jousted over public school finance, "Robin Hood," and the proposed city property tax rate.

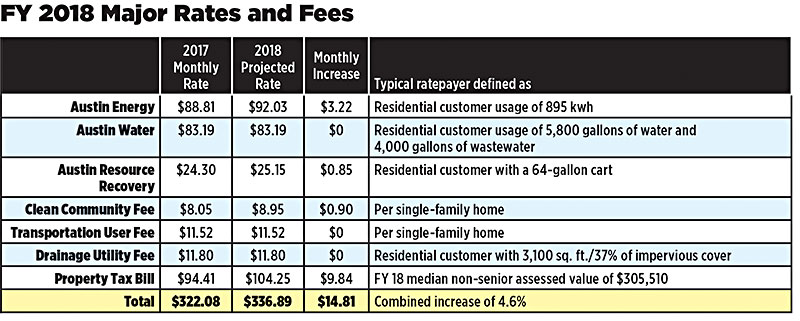

But before we get to that, consider the major numbers Van Eenoo presented to Council. There were no big surprises – overall the numbers fairly steadily tracked the spring budget projections – and no encouraging surpluses either, as Van Eenoo proposed a budget that, in Hart's terms, "maintains services while minimizing cost increases." It's not quite flat – if adopted as proposed, the new budget will cost a "median value" homeowner about another $178 for the year, in rising fees and property taxes. But neither is it ambitious, and as drafted, the budget would leave a scant $5 million for council members to consider spreading around for unmet needs such as public health, new fire stations, unfunded police positions, public school support, et al. Within an "All Funds" budget of $3.9 billion, and a General (Operations) Fund of $1.03 billion – and considering the outstanding needs – $5 million is almost literally pocket change.

More big numbers:

• Civilian employee wage increase: 2.5% (public safety TBD)

• "Living wage" floor, full-time employees: $14/hour ($15 by 2020)

• Median value home: $305,510

• Tax & fee increase (for a "typical" median-value home): 4.6% ($14.81/month)

• Proposed property tax rate: 44.51 cents/ $100 (current rollback rate; 8% increase, or $9.84/month for the median home)

• City property tax bill as percentage of median family income: 1.6%

Those numbers essentially update staff's spring projections, along with the expectation that there would be little maneuvering room between base expenses – keeping services roughly equivalent to FY 2017 – and any expanded or new initiatives council members might hope to contemplate. A few of the numbers merit explication: 1) The civilian employee wage increase is in line with recent years (though it may get shaved in subsequent discussions); 2) the $15/hour goal for living wage was established by previous Council decisions (and has benefited lifeguard recruitment while straining city golf course budgets); 3) the "median value home" is an approximate standard for measuring policy impacts, and is calculated by the taxing authorities at the Travis Central Appraisal District.

In terms of real increases, only Development Services (newly restructured to mostly pay its own way), and the Fire Department (where the slow pace of hiring is requiring more overtime funds) are expecting significant increases. The projected fee and tax increases on that "typical" homeowner (see chart) amount to just shy of $15/month, and will likely evoke much political rhetoric over the next month, until formal budget adoption in September.

Council Reacts

Council members are still digesting the presentation, and reactions from several members in the days immediately following the presentation were mild. Delia Garza said Council expected a "tough budget time" and applauded staff's efforts to find some unallocated funding. Her own priorities remain "addressing the lack of appropriate funding for the Public Health Department and for our affordable housing efforts." Serious additions in either direction would require substantial shifts in the budget, and Public Health (which now includes social service contracts) is in fact facing a $1.5 million reduction of one-time funds approved last year.

Jimmy Flannigan praised the basic staff proposal, while acknowledging the two-edged task facing the dais. "I hope the community remains engaged throughout this process," he said, "as we hear different constituencies desire tax cuts, but also increases in budgets for police, parks, pools, and transportation."

Leslie Pool has her eye on yet another concern: the fate of neighborhood pools in the wake of the just-released draft "Aquatic Master Plan." That issue is not addressed in the proposed budget, except by its absence; the modest ($2.9 million) increase proposed for Parks and Recreation will barely cover increased personnel costs, and does not begin to address the many millions needed for pool repair. CM Pool supports the mayor's move to increase the hotel occupancy tax, but said she opposes spending that money on expanding the convention center. "It would be better spent on our landmark tourist attractions, like Zilker or the MACC [Mexican American Cultural Center]."

Finally, Ora Houston, while also applauding the budget staff's "amazing job," raised simmering questions of how much control the city will actually have over its financial future. A couple of uncertainties – the outcome of the current public safety contract negotiations, and effects of any legislative action – should be resolved by the time Council has to approve the budget, but Houston noted another specter. "The major concern for me is at the federal level. The federal budget has the potential to positively or negatively impact the city's ability to continue to provide services to our constituents, from Aviation to the Women, Infants, and Children (WIC) program. If federal dollars, which support some of the services/programs the city operates or contracts for, are reduced or eliminated, there must be a Plan B."

Houston went on to recommend that $4 million of the $5 million "surplus" identified by staff be reserved for now, into next year if necessary. "If there are no reductions at the federal level, the $4 million in reserve funds can be allocated in the first quarter of 2018. ... My Plan B is to be conservative."

The State Property Tax

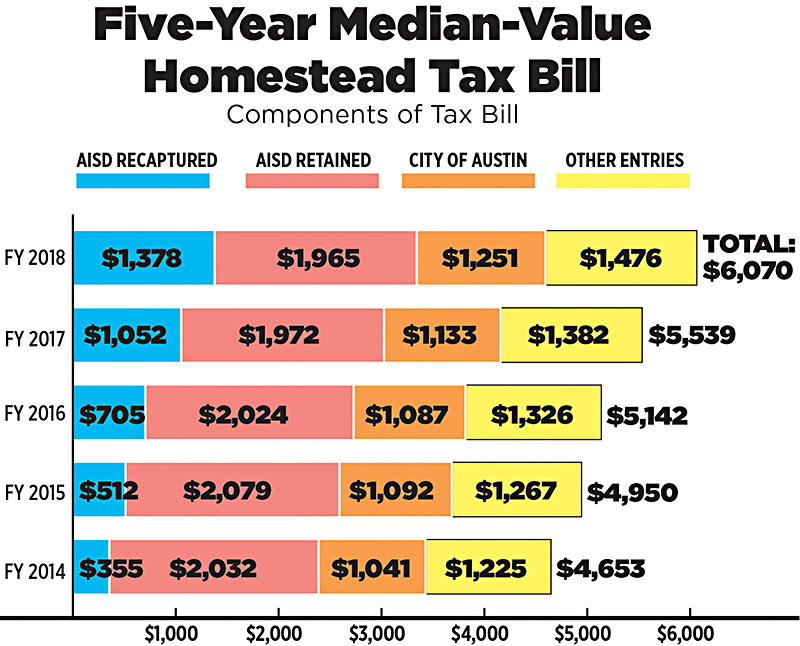

Making headlines from last week's budget work session was the civil but pointed debate between Adler and Troxclair, triggered by an unusual budget focus on the increasing portion of local property taxes heading to the state from Austin ISD taxpayers. Van Eenoo noted the unusual tangent for these discussions, addressing a chart reflecting the spike in "recapture" payments from AISD to the state, growing markedly over four years. In FY 2014, the school district kept $2,032 of its median homeowner's tax bill, while the state "recaptured" $355; for FY 2018, AISD is actually expected to retain fewer real dollars ($1,965) than it did in 2014, while sending to the state $1,378 for redistribution.

Even more remarkably, what the state will receive from recapture will outstrip the city's portion of local property taxes ($1,378 vs. $1,251 per typical taxpayer). In gross terms, Van Eenoo estimates that city property tax revenues will total $454 million, while AISD's recapture payments to the state (aka "Robin Hood") will come to $537 million – and spike even higher in the following years.

"Property taxes are no longer a 'local property tax,'" said the mayor. "Let's call it what it is: a 'state property tax.'" He didn't have to add that the Texas Constitution forbids the enactment of a state property tax.

That sparked opposition from Troxclair, who argued that the mayor's objection to "Robin Hood" taxation is hypocritical: The city doesn't mind taxing wealthier homeowners to redistribute benefits to poorer residents, she said. She's since begun an online campaign in that vein, demanding that the Council stop "pointing fingers elsewhere" instead of restraining what she called the "egregious" Austin property tax increases.

The mayor and other council members responded that they don't object in principle to Robin Hood wealth-sharing, but that – and here Adler cited his own experience on school finance matters as a legislative aide to former El Paso Sen. Eliot Shapleigh – it needs to be applied in a "fair and equitable" manner (as defined under the Constitution), and that Austin students (a majority of whom are poor) are being disadvantaged by the state's outdated funding formulas.

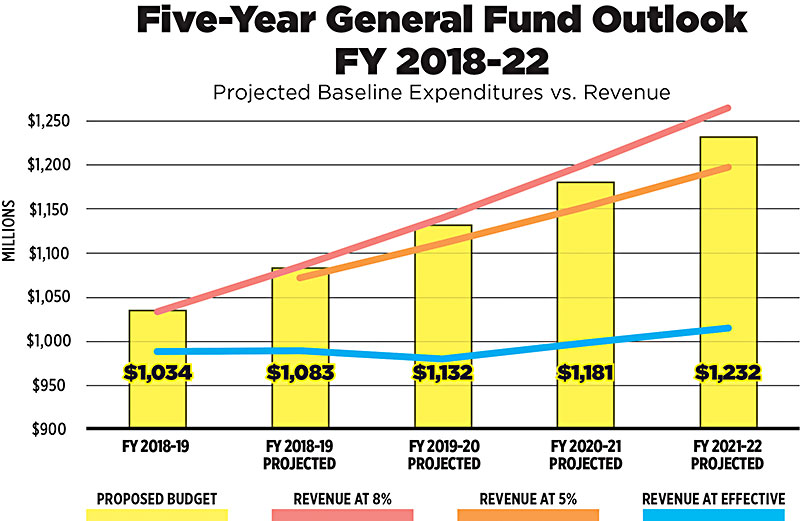

In terms of the budget process, the more immediate threats are the legislative proposals to further limit city taxing authority by imposing a rollback election trigger (currently 8%) at 5% or even 4%. "With a cap being threatened," Adler told Council, "I believe it would be prudent for any city to maximize this year's revenues in anticipation that it might not be there next year." He noted that Austin's property tax rate – thanks to property values – is much lower than other major Texas cities, and added, "Seventy-five percent of increases over the last several years comes from public school [taxes] – while AISD gets fewer dollars than they were getting four years ago. That's the 'egregious' element," he told Troxclair.

Troxclair was unpersuaded, but in light of these latest numbers will have increasing difficulty making the case that the property tax problem rests at City Hall. The mayor is sufficiently fired up on the problem to begin a mini-campaign, releasing a press statement on the "State Property Tax" and amplifying it in correspondence with the Chronicle.

"It's even more dramatic than I thought," Adler wrote, of the spiking state recapture share. "No wonder folks are complaining about property taxes, since they've gone up $1,400 in just five years for the median Austin homeowner. But ... the real, out-of-control taxing entity is the state, responsible for over $1,000 of the increase in taxes local homeowners pay! ... and AISD actually is getting less from that homeowner today in real dollars than it got five years ago!" He reiterated, "Over the last five years, for every dollar 'City of Austin' property taxes have increased, the state has increased its property tax (its recapture share) by five dollars."

With those stark numbers getting wider distribution, it's possible more Austin taxpayers will comprehend the source of the distorted Texas property tax system: the utter abdication of the Legislature to fulfill its constitutional obligation to provide a "fair and equitable" system of free public schools. Ann Kitchen – who also spent a term at the Lege banging her head against that intractable problem – summed up the situation: "The impact on folks of property taxes is the state's fault, and we need to make that case to taxpayers, who can communicate that to [the Legislature]. They're reneging on their responsibilities, and pointing to local jurisdictions for blame."

But in the current state of Texas politics, what's true and what's actionable can be very far apart. If the Lege persists in its determination to not only blame cities for rising property taxes, but to prevent local officials from addressing the funding problem – council members may well find themselves without sufficient funds for basic services. This year's problem could well become next year's crisis.

Got something to say on the subject? Send a letter to the editor.