City Budget: Something's Gotta Give

Cooling economy, rising costs mean tough choices for City Council

By Michael King, Fri., May 12, 2017

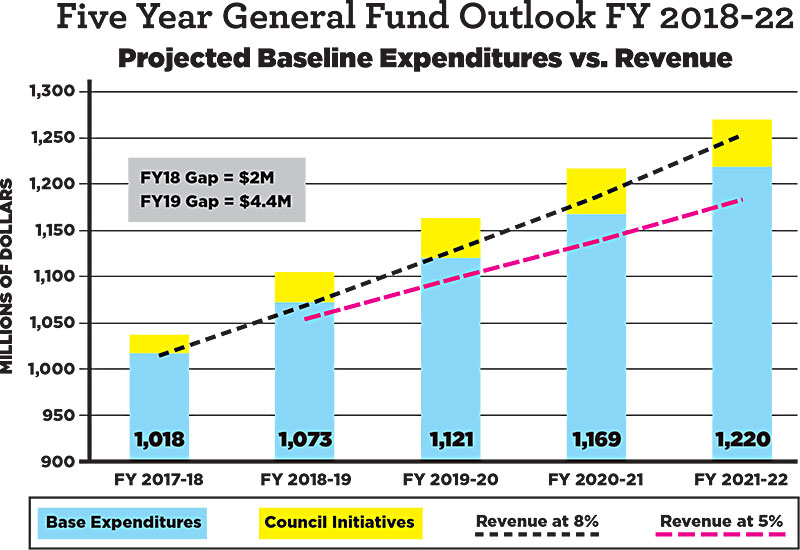

The current city budget predicament has a fairly simple frame: For the coming fiscal year, 2018, costs are expected to rise about 5%, and incoming revenue is anticipated to rise by less than 5%. That's an oversimplification – in budgetary matters, the devil is very much in the details – but that was the base message delivered on April 29 by Deputy Chief Financial Officer Ed Van Eenoo. Beginning his budget forecast presentation by citing a briefing he'd provided to City Council last August, Van Eenoo noted that the projected and the approved General Funds (operating) budget for Fiscal Year 2017 had topped out just about as anticipated, roughly $970 million, and sufficient income had accrued to meet that balance. "We could stop right now and ask for questions," he said, "because the story won't look a lot different than [it did last year]."

In the interim, Austin has continued to grow, expenses have continued to rise – but the booming economy enjoyed by the Central Texas region over the last several years has begun to cool, meaning this year's budget preparation (also as predicted) looks to be much tighter than the last couple of years. For the 10-1 Council (first inaugurated in 2015), "This is the toughest budget we've had," Mayor Steve Adler told the Chronicle last week. "We always knew this would be the hard year."

Austin is not entering a recession, or even hard times – but as interim City Manager Elaine Hart told Council just ahead of Van Eenoo, "We're forecasting a slower pace of growth for the Austin economy compared to recent years." That summation was given more detail in the presentation by consultant Jon Hockenyos of Texas Perspectives, who said that while the Austin area continues to outstrip the overall national economy, both are slowing – and since the city budget relies on local prosperity to sustain government funding, budget expectations become tighter and budgeting decisions more constrained.

Anticipating that discussion, Hart told Council that she had already directed that General Fund departments submit "no new request" budgets, and find overall 1% savings. (The sole exception is the Austin Fire Department, for reasons addressed below.) "We're also facing significant challenges in developing next year's General Fund budget, being able to balance the needs of our community with our available resources," Hart told Council.

The Big Numbers

Revenue

The forecast is not a budget – that won't be formally presented to Council until early August – but it does reflect the budget staff's best early summation of the current state of city finances and their best estimates of financial prospects for FY 2018, pending budget preparation and consequent Council policy decisions.

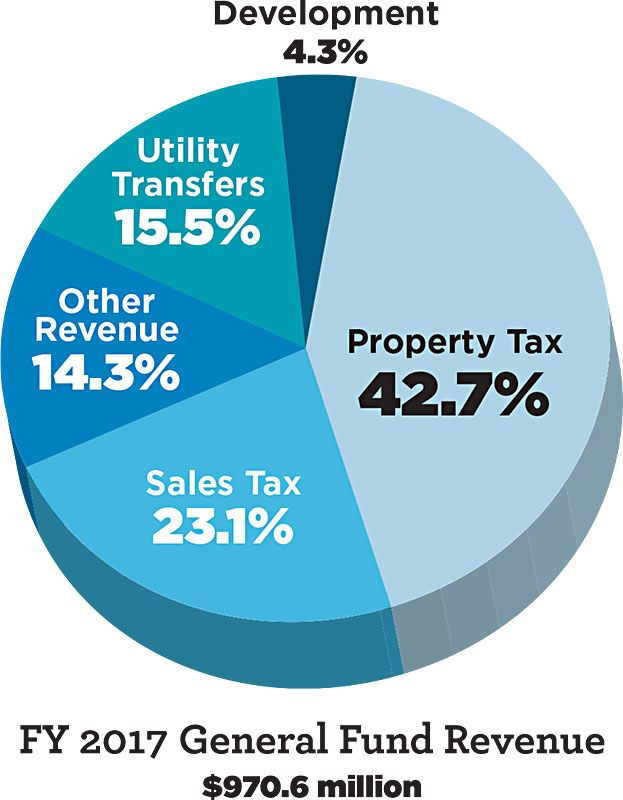

Although the entire city budget (aka "All Funds") is roughly $3.7 billion, that number includes all the "enterprise departments," which are essentially self-funding: Austin Energy, Austin Water, and Aviation are the big ones. Council does review the All Funds budget, but most of the policy consternation concerns the General Funds budget, representing about 22% of All Funds. The FY 2017 GF total, $970.6 million, pays for most of what Austinites consider "city services": police, fire, EMS, parks, libraries, health and human services, etc.

The two primary sources of GF revenue are property taxes and sales taxes, amounting this year to about 66% of the total GF income. The rest comes from utility transfers (15.5%), development revenue (4.3%), and "other" (14.3%) – the latter including various sources: EMS revenue, franchise fees, mixed beverage taxes, traffic fines, even bingo. In recent years, development revenue (from new commercial and residential building) has been unusually high; like sales taxes, that source tends to be much more volatile than property taxes. In recent years, property taxes have grown as the major percentage of GF revenue.

Expenses

On the expense side, the single largest category of spending is for Public Safety: Austin Police Department, Austin Fire Department, and Emergency Medical Services. Those three together represent just under 68% of the General Fund budget, a percentage that has held roughly steady for the last several years. Arguably, Municipal Court (2.3%) should also be included in that tab, which would push the total above 70%. At right is a breakdown of the major GF departments, accounting for 95% of GF spending.

Estimated FY 2018 Rates and Fees

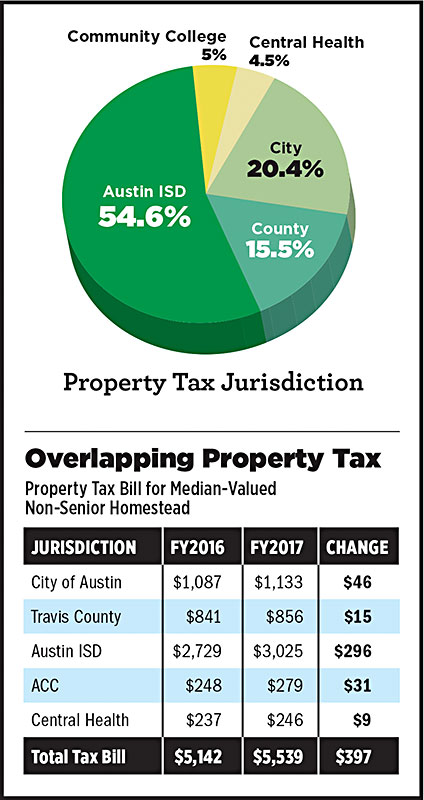

This year's monthly city bill (property taxes and fees) on the "typical" residential homeowner (aka "median, non-senior homestead value of $269,264") has been $322.08. The early forecast – before an actual budget, any Council decisions, or TCAD property tax roll – estimates a combined increase of 2.3%, with most of that jump attributable to another strong increase (est. 8.9%) in local property values, slighter rises in utility-related fees. If those early estimates were adopted as is (unlikely), that residential bill would increase by $7.34 per month, to $329.42.

"Cost Drivers"

The forecast anticipates an overall 5% increase in what are called "structural cost drivers" – that is, rising expenses based on either contractual obligations, anticipated personnel costs, equipment upgrades, and other ongoing expenses. The single largest increase is anticipated for personnel: That includes cost of living increases, market comparison raises, "pay-for-performance," any raises associated with the public safety union contracts (all currently in negotiation), and any new hires. Staff has set aside a "placeholder" estimate for this category of $17.5 million.

That's the biggest higher price tag. There's a long list of other cost drivers that begin with health insurance increases ($4.6 million); communications and technology upgrades ($4.4M); support services ($3.9M, which includes City Council itself); AFD overtime ($3.5M); fleet and fuel costs ($2.6M), and so on. A few of these have been fairly high profile over the last couple of years, based on Council initiatives: staffing the new Central Library ($1.9M); the new Sobriety Center ($1.2M); new Onion Creek fire station ($1.2M); APD body cameras ($1M). Others reflect bumps in ongoing expenses.

The total comes to $47.8 million in increased expenses, just under the 5% overall estimate. And that's after a $4.5 million reduction in "one-time" expenses added by Council initiatives in the FY 2017 budget. Those initiatives included funding for AISD parent support and afterschool programs (in part as a way of lightening the higher burden of AISD property taxes), the affordable housing trust fund, and several "quality of life" initiatives aimed at improving social equity. Those programs were hard-fought and important for several City Council members, but it's not yet clear if Council and staff can find funding to continue them, over and above the 5% in "cost drivers."

Vexing Questions

So, at the outset, the budget preparations begin with the question of how to meet basic expenses. In the recent boom years, the combination of property taxes and sales taxes has been nearly enough to carry basic expenses, with utility transfers and other revenues supplementing the rest of the GF budget, along with some additional initiatives, for recent example: the new Central Library, expanded Animal Services, and supplemental funding for programs in Health and Human Services. With the economic boom receding, interim City Manager Hart directed departments to scale back, and Van Eenoo reiterated to Council that the initial challenge will be meeting basic expenses.

Describing an annual 5% growth rate in expenses as "typical," Van Eenoo recounted this year's consequences. "In order for our expenditures to grow 5 percent and to keep the General Fund budget in balance, which we're required to do by state law, we need all of our revenues to grow by 5 percent, in aggregate. … But what's been happening is sales taxes haven't been growing 5 percent; the 10-year compound annual growth rate is closer to 4 percent. The utility transfer and those other revenues haven't been growing anywhere near 5 percent; they've been growing closer to 1 percent. And so when you have big chunks of your revenues growing less than that 5 percent expenditure growth rate, then some other revenue source, in this case property tax, has to grow more than 5 percent."

That's the primary dilemma facing Council this budget season. In the short term, the budget will be bailed out by rising property values (expected to hit 8.9% this year), but for the next couple of years, the budgeteers expect a $2-4 million gap between revenues and basic expenses – meaning Council will have to establish clear priorities and adjust where they can. The city manager's 1% reduction is expected to save $8.9 million – but that's still a long way from $48 million.

For the most part, council members seem prepared for the challenge. CM Leslie Pool noted that most 10-1 CMs are in their "junior year" (the third since the 2014 election), and have adequate preparation for what's to come. CM Delia Garza said that the budget staff "had given us a pretty good warning last year," adding, "In some ways, it might make things a little easier, in that it looks like we simply won't be able to afford to take on additional spending." The final days of the budget cycle usually mean horse-trading among myriad potential programs; this year there will be fewer horses to trade.

Interestingly, the two rookie CMs – Jimmy Flannigan and Alison Alter – both say they want to take closer looks at the budget process itself. Flannigan has proposed a two-year budget planning cycle instead of the current one-year process; Alter says Council needs to pay better attention to the budget implications of specific contract and even zoning decisions through the course of the year's agendas. "I do think that it's helpful to look at it as more than three months out of the year," Alter said. "We need to be fiscally prudent every week."

In that vein, council members will have plenty to ponder. A few highlights:

Firefighter Overtime

Much of last week's budget work session was devoted to AFD Chief Rhoda Mae Kerr's briefing on the $3.5 million gap in the AFD budget, primarily a consequence of vacancies accumulating through the years-long attempts to comply with Council directives and a Justice Department consent decree mandating better diversity in hiring, the slow pace of those additional hirings, and the consequent overtime costs associated for current firefighters filling the gap. Interim City Manager Hart has exempted AFD from the 1% cut imposed on other GF departments, and anticipates adding another $500,000 to the budget to fill the gap. There was even some discussion of returning to a three-person staff model on responding fire trucks, from the four instituted a decade ago. It seems unlikely that option will prevail, and in the short term even the hiring solution costs more money until it begins to draw down overtime.

Trying to Shoot Par

The city's golf courses, managed under Parks & Recreation, are nominally an "enterprise" program, but in fact regularly lose money and are supplemented from GF revenues. Unlike other PARD programs – parks, swimming pools, soccer fields – the city's Golf ATX program is (sort of) expected to pay for itself, although it never quite does so, and PARD expects another $500,000 supplement in this budget. (It doesn't help that many residents consider golf, unlike other recreational activities that the city also subsidizes, a luxury sport.) Council took a harder look at that spending this week; alone, it's not a big ticket item, but contributes to the $48 million "cost driver" deficit that must be addressed.

Is It Safe?

The perennial, large conundrum is what to do about public safety spending, about 70% of the GF budget, including the 40% represented by APD (a subject also complicated by the financial pressure on AFD). Recently, the mayor surprised the dais by floating the notion of a "percentage cap" on public safety spending (a notion to be aired out at Wednesday's latest budget work session). Some activists who testified to Council following a briefing on union negotiations a couple of weeks ago were demanding a freeze on the APD budget – but the higher priority appeared to be increased officer accountability. Until those negotiations conclude, staff can't itemize potential personnel costs. The mayor told the Chronicle that he hopes to develop a "five-year plan" to address overall public safety spending.

In recent years, some council members have argued successfully that a broader notion of "public safety" includes such programs as mental health care, aid to public education, homeless initiatives – social services generally – as preventative measures that in the long run lead to less expense on law enforcement.

Homestead Exemption

In 2014, most council members campaigned on a homestead exemption, and the 2015 Council instituted a 6% HEx, with the express intention to achieve the limit of 20% in four years. Last year, by a 6-5 vote, they added 2%, reflecting diminishing enthusiasm as well as funds. At the moment, only a couple of CMs (Ellen Troxclair, Ann Kitchen) have expressed a sentiment to raise it this year, and others who voted for it previously (Adler, Pool) have suggested there's not enough flexibility for more in this year's numbers. (Because of state deadlines, they must decide on a HEx before they have a budget in hand.)

In FY 2016, the cost of that 8% exemption was estimated at $15 million, and it would be at least that much this year. By August, Council might find themselves yearning for some of that money.

Wild Cards

Looming over all these issues are potential decisions at the Texas Legislature, most of which would spell additional burdens on municipalities and city budgets. Some of the shadows:

Property Tax Hammer: The Republican Lege is considering a 5% "rollback rate" on property tax increases (the current cap is 8%). In theory, it would allow a rollback election in years when the city needs to exceed the cap; in practice, beginning in FY 2018, it would exert strong downward pressure on city spending, without reducing growth or lessening community needs. Should it pass, budget staff predicts a compounding reduction in funds: $13.8 million in FY 2019, $68.4 million by FY 2022 (see chart above). Noted Mayor Adler: "The effect would be catastrophic, and we'd have to let people go."

No Sanctuary: While the worst effects of Senate Bill 4 – the crackdown on so-called "sanctuary cities" – fall on undocumented Austinites, the law also represents another unfunded mandate on local police departments. It's likely to be challenged on constitutional grounds; it's also fiscally irresponsible.

Ungranted: Should the state and the federal governments follow through on threats to withdraw grant funds from cities they deem uncooperative on immigration enforcement, Austin stands to lose $9.8 million in state grants, and $42.7 million in federal grants. Such a move would certainly meet legal challenges, and would be extremely shortsighted, even malicious. Considering current state and federal priorities, that doesn't necessarily mean it won't happen.

No Linkage: The Strategic Housing Blueprint recommended a "linkage fee" that would require new developments to provide a (square footage-based) fee to help underwrite affordable housing. The fees have worked well elsewhere, but met fierce opposition at the Capitol from developers and real estate interests, and based on votes last week, it appears will be banned in Texas, foreclosing one more opportunity to address inequality.

Council Priorities

If they find their way through that thicket of obstacles, council members will be considering which programs to maintain or find new funding for. Several members told the Chronicle specific programs or initiatives they still hope to emphasize, even in a tough budget year.

Delia Garza: "I'm still focused on Health and Human Services, or what we're now calling, I guess, 'Public Health.' A good portion of the budget goes to 'Public Safety'; money we spend on preventative mental health or homelessness contributes to Public Safety."

Pio Renteria: "The Public Safety costs – right now, especially AFD – are a big hit. I'm going to be looking for ways to address that. If we can't fix that, there will be less money for the Housing Trust Fund or Homestead Preservation, which are big priorities. … I'm also hoping to find money for public arts, minority artists, at the old Holly Power Plant site."

Greg Casar: "We need to keep our equity initiatives on track, especially the Living Wage, and the Housing Trust Fund. I'd also like to keep our support for immigrant legal services as a permanent budget item. The tight budget doesn't present a lot of opportunities."

Jimmy Flannigan: "I'm focused on the budget process right now, hoping to get some support for a biennial planning cycle. Since we don't yet know what the Legislature is going to do, and the outcome of the union contract negotiations, it's difficult to know what else we'll be able to do."

Leslie Pool: "We've been able to drop the property tax rate a bit each year; I hope we can maintain that. Beyond that, my priority will be taking care of City of Austin employees, and I don't want to back off from our commitment to Health and Human Services."

Kathie Tovo: "I want to identify funds for affordable housing, and continue to support Health and Human Services. I'd like the city to move forward as quickly as possible on affordable housing on public lands, like the HealthSouth building. And I hope we can find additional ways to offset parks funding with hotel/motel taxes."

Alison Alter: "My priorities remain parks and open spaces, transportation and mobility, investing in our children, and wildfire protection and senior services. And we should not think of the budget process as only three months of the year."

Mayor Adler: "I haven't settled on anything like additional items; right now I'm much more focused on the process, and perhaps some quality of life items. We're going to spend a lot of time discussing Public Safety. There will not be a lot of dollars in play."

Got something to say on the subject? Send a letter to the editor.