City Council Clashes Over 2017 Budget

Competing ideas on how to spend $969 million

By Michael King, Fri., Aug. 19, 2016

Although it's been out of the headlines for a week or two, City Council remains knee-deep in deliberations over the fiscal year 2017 city budget. In its largest incarnation, that's the $3.7 billion "All Funds" octopus, which includes not only the operational expenses or "General Fund" budget, but the "enterprise" departments, which are income-generating and essentially self-funding: most prominently, the utilities Austin Energy and Austin Water, but also the airport (Aviation) and the Convention Center. Although Council does annually review the All Funds budget, its primary focus is on the 22% of All Funds that is the General Fund budget – this year projected to be about $969 million, and funded primarily from property taxes, sales taxes, and revenue transfers from those city-owned utilities. The General Fund is what pays for most of what residents generally consider city services: police, fire, EMS, parks, libraries, health and human services, etc.

(If you're wondering where the $720 million Mobility Bond now headed to the Nov. 8 ballot fits into these big numbers, the answer is, nowhere. Bond monies are segregated into capital projects funds, are officially and legally dedicated to those big infrastructure projects, and are a subject for another day – e.g., Aug. 5: "What Would $720 Million for Transportation Buy?")

In the annual budget-planning rhythm, city staff presents a forecast in the spring (this year, April 27), receives initial feedback from Council, and returns with the city manager's proposed budget in midsummer (this year, that proposal was presented on July 27). Council then spends the next six weeks reviewing, accepting, rejecting, or adjusting the city manager's recommendations – within the limits of existing contractual obligations and policy decisions they've already made.

Budget Changes

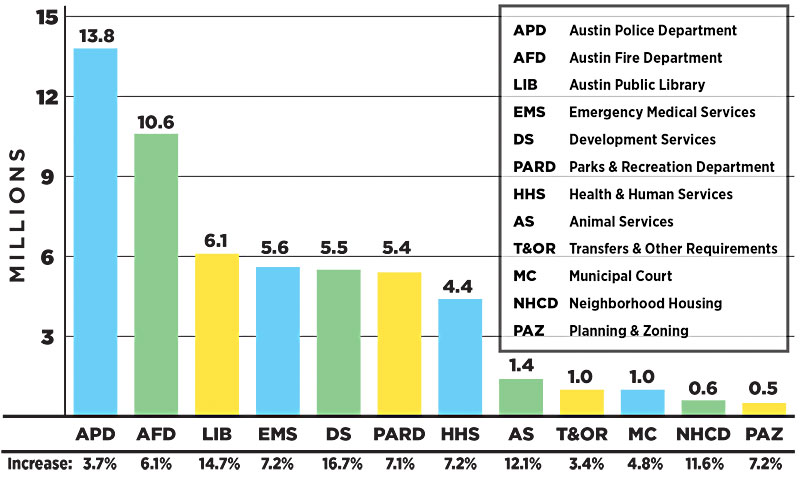

This chart shows the $56 million in budget increases recommended in the city manager's proposed budget, with the percentage increase based on each department's budget. For the Austin Police Department, a $13.8 million increase represents only 3.7% of the APD budget; larger percentage increases for Libraries and Development Services represent a much smaller dollar figure.

The Raw Ingredients

The discussion begins with the city manager's numbers, derived from Council decisions and stated policy priorities, and the projected needs of the individual departments. Overall, the proposed $969.2 million General Fund budget represents a $56 million increase over FY 2016.

As the "Budget Changes" bar chart reflects, over half of that $56 million would go to the usual suspects: APD ($13.8 million); AFD ($10.6 million); EMS ($5.6 million). An anomaly this year is $6.1 million for Libraries, primarily to pay for staffing and operations of the new Central Library. Development Services – under the gun last year for inefficiency and slow service – would get the largest percentage increase, at 16.7%, or $5.5 million. (The DS plan is to steadily raise user fees to make the department self-sustaining, over the next two to three years.) Parks & Recreation and Health & Human Services are scheduled for increases just over 7% (together $9.8 million). Those seven departments account for more than $51 million of the projected overall increase.

Although every such change is subject to Council's current review, some increases are already baked into this year's spending by last year's decisions. For example, a handful of Council initiatives begun last year will cost $7.5 million in this one: new EMS staffing to allow 42-hour weeks ($3.4 million), additional police overtime for spring festivals ($1.5 million), now-annual cost of the new Shady Hollow fire station ($1.3 million), etc. Beyond policy changes, structural obligations drive other increases: Public safety salaries are determined by previously negotiated contracts – 2% increases for police, fire, and EMS – and the draft budget recommends a similar 2% "performance-based" increase for the city's roughly 14,000 civilian employees. Employee health insurance costs are expected to increase by 8% – the spring projection was 12%, so the city restructured its insurance program and proposes a $600/year across-the-board wage increase (29 cents/hour) to compensate for higher co-pays.

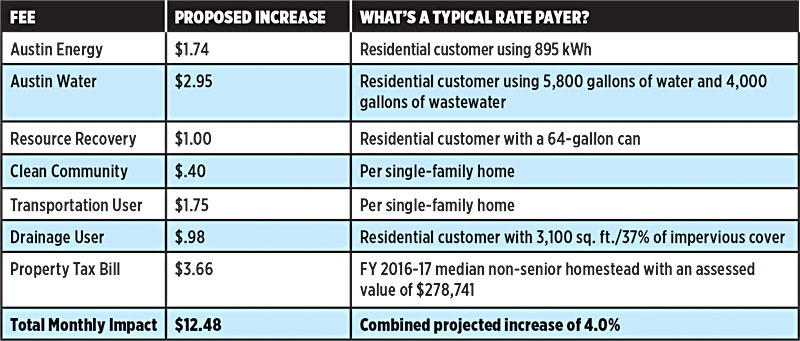

All of these increased costs translate to estimated increases for Austin taxpayers. Should the changes be approved as is, they would accumulate to a schedule of increases for the "typical" Austin homeowner of a median-priced house ($279,000) to a total of $12.48 per month (see chart "Proposed Monthly Fee & Tax Increases" below). The property tax rate is expected to decline from this year's 45.89 cents per $100 valuation – but because of rising property values, the property tax bill is expected to increase about 4% (part of the overall 4% increase for taxes and fees together). Over the last couple of years, Council has attempted to buffer those increases in a couple of ways: adding a homestead exemption (bumped from 6% to 8% prior to the budget discussions), and now a proposed $5,000 increase in the senior and disabled exemption (from $80,000 to $85,000, tentative but likely).

City Manager Ott also directed his department heads to squeeze additional monies from their budgets to address specific Council priority projects. Ott's draft budget includes $3 million for those projects, including the Affordable Housing Trust Fund ($1.1 million); "Housing First" funds to address homelessness ($600,000); Downtown Sobriety Center ($380,000); and Colony Park Master Plan ($217,000). Some council members have expressed concern that the budget does not include more for these kinds of programs, and in the final days, it is around these rather small margins that most of the budget debate occurs.

Proposed Monthly Fee and Tax Increases

This chart reflects increases recommended in the city manager's proposed FY 2017 budget, subject to Council approval. Since this draft was released, the TCAD certified property tax roll was updated (affecting the anticipated tax rate), and this week the city announced an agreement expected to lower anticipated Austin Energy rates.

Working the Numbers

In Council's budget work sessions, the various department heads have been marching into the Boards and Commissions room to deliver PowerPoint breakdowns of their individual budgets, a half-dozen at a session. Depending on the department – Animal Services, say, vs. Austin Water – the presentations and the Council grilling can be short and sweet, or lengthy and sour. Most of the exchanges are polite and inquisitive – even from those conservative members looking reflexively for ways to cut costs. The most common exceptions are exchanges triggered by CM Don Zimmerman, who often targets particular staff members for aggressive questioning and periodically denounces "unelected bureaucrats" for doing their jobs – that is, administering programs established by previous Council directives.

At the Aug. 10 session, Economic Development Director Kevin Johns summarized the work of his department, with a particular emphasis on recent programs designed to promote creation or recruitment of "middle-class" jobs aimed at currently low-income residents. That made it Johns' turn in Zimmerman's barrel, because Zimmerman opposes any and all "subsidies" for economic development. CM Pio Renteria asked an informational question about the relationship between Cultural Arts programs administered by Johns' department and those sponsored by Parks & Recreation, and was told PARD only handles particular programs hosted in the parks. Zimmerman interposed: "I would offer a separate explanation to Council Member Renteria. I think the short answer is so the city can spend more money."

Mayor Steve Adler followed Johns' presentation (and Zimmerman's objections) with a spirited defense of economic development, arguing specifically that the city hasn't consistently been aggressive enough in pursuing the kinds of manufacturing jobs that could raise up low-wage workers and help address income inequality. "I think that the single biggest threat to Austin, Texas, preserving what is special about this city and its spirit and soul," he said, "is not providing that equity in our city, and those middle-class jobs and the training for people who live in our city to take those middle-class jobs."

Zimmerman responded angrily that the city had done just fine for decades "without the bureaucracy" and that among voters he talks to in his re-election campaign, "there's universal opposition to this taxpayer-subsidized Economic Development Department." Amid the arguments between "no-growth" and "pro-growth" extremes, Zimmerman insisted most Austinites agree with him. "Don't prohibit growth and don't force me to subsidize growth," he said. "And don't tell me that a handful of unelected bureaucrats are smarter than the rest of the city. Don't tell me that." Zimmerman is apparently oblivious to the fact that without hundreds of millions of dollars in growth subsidies – in the form of state highways and other major infrastructure (marked again for expansion in parts of the November Mobility Bond) – the district he represents wouldn't even exist.

More generally, council members use the work sessions to get up to speed on departmental changes and to raise questions to be pursued when their budget adjustments begin. For example, CM Sheri Gallo (joined by Zimmerman) is recommending that – for "better transparency" – the Cultural Arts programs be moved out of Economic Development into their own department, while Zimmerman is proposing that the rest of the ED Department be abolished altogether. Other members are recommending less-drastic changes, not yet voted upon but compiled and allocated for further review by the budget staff.

FY 2017 Budget: All Funds

The "All Funds" budget includes all city departments, both "enterprise" (revenue generating) and General Fund (operational expense) departments. The two largest enterprise departments are the city-owned utilities (Austin Energy and Austin Water). The GF budget represents about 22% of all city expenditures.

General Fund

These are the largest categories of spending in the "General Fund" or operating expenses budget, currently projected at $969.2 million for FY 2017. Public safety spending (police, fire, emergency services, municipal court) now comprises more than 70% of GF spending; all other community services (parks, libraries, health and human services, etc.) comprise about 22%.

Rewriting the Menu

The product of that compilation is the "Concept Menu," devised by Adler last year for tracking proposed budget amendments. Posted on the Financial Services web page (www.austintexas.gov/financeonline/finance/index.cfm) and updated each afternoon, it enables Council to follow potential amendments and (once calculated by budget staff) their financial effects. Initially, individual council members can suggest proposed amendments; as the days proceed, amendments that receive no (or too few) co-sponsors will be winnowed from the list, while others move forward.

A select few of the earliest proposed amendments (and potential plus/minus dollar budgetary effects) include:

• Eliminate the Economic Development Department (Zimmerman): –$15.5 million

• Eliminate utility funding of Economic Development Department (Gallo, Ellen Troxclair): –$10.7 million

• 3% Cost of Living increase for civilian employees, instead of 2% (Greg Casar): +$10.1 million

• Present budget at "effective" property tax rate, same revenue as last year (Gallo, Troxclair): –$36.4 million

• Add support for AISD programs (Kathie Tovo, Adler, Casar, Leslie Pool): +$2.2 million

• Reallocate $6.8 million (1%) from public safety departments to Health and Human Services (Delia Garza, Adler, Pool, Casar): Neutral

• Provide full funding for minority Quality of Life programs (Ora Houston): +$11.6 million

That's a small selection from the dozens of potential proposals floated in Council's Concept Menu as of Tuesday, Aug. 16, and were they all adopted (impossible, as several are contradictory) they would result in many millions in dramatic changes in city income or spending. Right now, they are little more than running notes of what's under discussion – and the larger the proposed change (and the fewer sponsors), the less likely it will be adopted. Another major factor is that there is little obvious wiggle room in the draft budget proposed by the city manager, which did not include, for example, a few programs previously approved by Council. Asked about the omissions, the budget staff responded that the money simply isn't available.

After the budget was drafted (indeed, the July 27 morning of the initial budget presentation), staff learned that a late correction by the Travis Central Appraisal District meant the "rollback" property tax rate would actually be a little higher (44.18 cents/$100 vs. 44.11 cents/$100) – a potential windfall of about $850,000. That might help pay for a few of the missing programs (e.g., $150,000 for an initial Downtown public toilet sponsored by four CMs), but it would not begin to touch already-expressed needs for either increased public safety funding or, at the other end of the political spectrum, more social services funding. Meanwhile, Council is in the midst of revising Austin Energy rates – under the gimlet eye of the state Public Utility Commission – and the initial buzz is that AE rates will indeed be adjusted somewhat downward: good news for ratepayers, difficult news for council members and budget planners trying to make the revenue and spending balance.

Beyond the specific proposals raised in the Concept Menu, at least two groups of advocates have resumed the annual tug-of-war over Council budget priorities. Following the budget presentation, Garza joined social service advocacy groups in publicly calling for more spending on health and human services – a previously projected $8.3 million increase had been reduced to a $4.4 million staff recommendation. Arguing that money spent on social services returns tangible economic benefits, Garza said, "It is so important that we support these programs, because they are so essential to so many people."

Simultaneously, the Public Safety Commission and the Austin Police Association (among others) are pressing for more spending for APD. Armed with a recent consultant's report by Matrix Consulting Group that recommends hiring more than 100 new positions (including 66 patrol officers and various other personnel), public safety advocates are looking dimly on the draft budget's addition of only 33 new positions (12 sworn officers, 21 civilians). Following the release of the draft budget (but prior to the Matrix report), APA President Ken Casaday had said, "Not adding enough officers and withholding funding [for previously approved positions] means there will be about 85 less police officers on the street this upcoming year." That conversation is likely to continue.

The conflicting priorities are sure to preoccupy Council over the next several weeks. Last year's relatively flush budget – including a widely applauded boost in social service spending – is a fading memory, and at least some CMs might find reason to regret enacting an annual $15 million (and growing) pre-budget expenditure, in the form of an 8% homestead exemption. That revenue is gone – permanently.

Although there will be much huffing and puffing on the way, in the end, Austinites can expect that overall FY 2017 General Fund spending will land just about where it was last year: more than 70% for public safety, roughly 22% for all other community services (parks, libraries, health and human services, almost everything else; see chart).

Asked last week about the overall budget prospects, Adler said he anticipated that the final numbers would conclude fairly close to the staff recommendations, although he hopes to be able to move or provide some additional spending (e.g., the funding for AISD parent specialists and afterschool programs). He's grown fond of noting that the city taxes and fees together represent a relatively small portion of median family income (about 1.7% in property taxes; with taxes and fees altogether, roughly 5%). That also means that the annual ongoing budget arguments over a tax-and-fee increase (currently projected at 4%) represents about .04 x .05: .002 – or .2% of the typical family income. By contrast, the mayor points out, housing and transportation costs represent 37%, "and that's where we need to look to have a substantial effect on affordability." He argues that improving transportation (through the Mobility Bond, for example) and increasing the housing supply (especially by increasing residential density) represent the most effective ways to address affordability as well as economic inequality.

When he initially proposed the November bond, the mayor made the broader argument: "We can't be focused on saving a few dollars on property taxes. If we're serious about affordability in this city, then we need to focus on housing and transportation costs. That's why Austin is unaffordable to so many. The past-due bills on mobility and affordability are stacked high in Austin. It's time to pay them." The next couple of months will focus on the city budget side of that affordability balancing act. After the final September budget adoption, the financial and political focus will turn to the voters' decision on Adler's November "Go Big" Mobility Bond.

Today's City Council agenda (Aug. 18) includes public hearings on the proposed FY 2017 city budget and property tax rate, as well as related hearings on Austin Energy, Austin Water, and Austin Resource Recovery rates and fees, and "growth-related" capital projects. Additional AE rate hearings are scheduled for Aug. 22 and 25, and a public hearing on the budget and tax rate for Sept. 1. The formal budget adoption votes are scheduled for Sept. 12-14.

Got something to say on the subject? Send a letter to the editor.