Developing Stories: Private Projects, Public Benefits

Could developers become Austin's new benefactors?

By Katherine Gregor, Fri., April 6, 2007

Austin has begun to wise up about how much developers can be expected to do – often willingly, when asked – to help advance the broader public good. Developers of some high-dollar private projects in Central Austin are agreeing to provide public benefits that go far beyond a handsome facade (as developers long have been expected to do in other leading U.S. cities). Until recently, the city hasn't required much of developers beyond "economic development" – too often a euphemism for business as usual. But now that Austin has, by some indicators, the strongest municipal economy in the nation, we've been somewhat emboldened to raise the bar and ask for more, while the getting's good. City Manager Toby Futrell often cites the city's official vision: to become "the most livable city in the country." As developers resculpt the cityscape for private profit, they need to contribute to livable city goals – such as affordable housing, parks and open space, public transportation, a clean environment, climate protection, and equity of economic and social opportunity.

Austin is just now feeling its way toward a standard public-benefits policy – often called a "density bonus" – for developers who seek upzoning to build denser and taller in the urban core. Some council members are considering a point-system matrix of community benefits, which would allow more fair and uniform deal-making. Brewster McCracken says he hopes to start with a scoring system for PUD (planned unit development) zoned tracts and then expand the system to other zoning in order to measure how well a development meets community, city, and even regional (e.g., Envision Central Texas) policy goals. Not unlike the "Chinese menu" matrix incorporated into the city's design standards, a point system would reward "good behavior" like affordable-housing contributions and green building. Developers would use points to earn "density bonuses" of additional square feet and upzoning on projects. (While Texas law limits what the city can require in this regard, a long-established tradition upholds the right of U.S. municipalities to assess "impact fees" on projects that increase the need for city services and amenities.) To date, such deal-making in Austin has been too inconsistent, political, and exhausting; as McCracken said at council recently, this ad hoc approach needs to mature into a consistent set of city policies.

At least we're finally having the conversation.

Here we consider several recent development doings notable for the light they shed – or issues they raise – on a range of opportunities for interplay between private development and the public good.

Tug of Benefits: Parks vs. affordability

The dynamic, confusing, and, at times, contradictory current thinking about developer-financed public benefits was deliciously illustrated at City Hall last week. In one room, Planning Commission heard a presentation from the Affordable Housing Incentives Task Force. One task-force recommendation was that, to enhance affordability, the city should waive all parkland-dedication fees on all new developments in which at least 10% of residential units qualify as affordable under city SMART Housing guidelines.

But the parkland-dedication fee is a critical source of revenue to acquire and improve city parks, a parallel public good. So across the hall, the Parks and Recreation Board was working on an amendment to the city's parkland-dedication fee ordinance, to expand the fee to all new residential projects, including Downtown condos. Yet many of those same condo projects are likely to reserve 10% of units as affordable housing (or pay a fee-in-lieu) to qualify for city incentives such as upzoning – which would then exempt them from the parkland fee altogether, if the Affordable Housing Incentives Task Force has its way.

So, who's on first?

Seeking a middle ground, the Parks Board passed a compromise recommendation: Grant a parkland-dedication-fee waiver, but apply it only to the affordable units themselves, not to the project as a whole. This recommendation was made by Warren Struss, director of the Parks and Recreation Department, in a March 9 memorandum to Paul Hilgers, director of Neighborhood Housing and Community Development (which implements the city's affordable-housing programs). Said Struss, "I cannot support the waiver for the entire project." He cited "a pronounced adverse impact on the park system without the benefit of parkland dedication funds for enhancements."

Siding with the Parks position, the Austin Neighborhoods Council has adopted a resolution supporting the parkland-dedication-fee waiver only on affordable units, not on entire projects. (In addition, ANC is advocating for an affordable-units-only waiver on vertical mixed-use projects; currently, the city's new design-standards ordinance provides a complete waiver for VMU projects.)

Getting it from both sides at their meeting, several Planning commissioners were openly flummoxed by the inherent contradictions – give us affordable housing, give us parkland, or split the baby.

Waller Creek Revival

"There was something in it for everybody," said Council Member Sheryl Cole, explaining why she has championed the long-discussed, finally funded floodwater bypass tunnel along Waller Creek Downtown. Cole ticked through a populace-pleasing list of public benefits: improved water quality, Downtown vitality, a future recreational trail, enhanced tourism, linking the east and west sides, and, of course, economic development.

Spreading the cost across the public and private sectors, in a sense, this $123.6 million capital-improvement project is being funded by creating a tax-increment financing district. The TIF district requires approval by both the Travis Co. Commissioners Court (accomplished last week) and the city of Austin (pending but considered a done deal). It creates new revenues by opening up land (more than a million square feet) along Waller Creek for redevelopment and improvements. By removing prime Downtown land from the 100-year floodplain, the tunnel will stimulate new development, which in turn will generate new tax monies. Instead of going into the city's general fund, those additional tax dollars – revenues above and beyond what the properties are generating in their unimproved state – will go to pay off the Waller Creek tunnel.

Critics didn't like the fact that private landowners along the creek will be the ones to benefit financially from a public-works project. But with Waller Creek at present an urban blight akin to an open sewer, a strong public interest in improvement prevailed.

TIFs are becoming increasingly popular around town as funding solutions. Although they can be overused, to the detriment of general city revenues, they do make sense for major capital-improvement projects that produce higher property values and thus new tax revenues. Property owners don't pay more taxes than they otherwise would on the projects developed, but some of the money is dedicated to paying for the infrastructure that made their developments possible. TIFs already are in place for Seaholm and the Domain. They're also being proposed for the Capital Metro streetcar line, the Austin-San Antonio rail corridor, and the Eastside Homestead Preservation District. Concerned about too many TIF dips, council's Audit and Finance Committee is seeking a full accounting of the total general fund drain that TIFs in place and in progress would represent.

The tunnel is essentially the same flood solution that made the San Antonio Riverwalk possible (although Waller won't be paved, instead retaining its natural rock creek bed). "Bringing together over 21 miles of trails between Town Lake and Waller Creek [at Waterloo Park] will add a new dimension to Downtown that will truly connect the city," said Cole, who envisions a park trail system (and perhaps a low-key, Austin-style Riverwalk development) along the waterway. With a stable water level ensured, projects could be built right up to the new waterfront.

However, the TIF district funds cover only the $123.6 million cost of building the tunnel itself and the inlet and outlet structures. (These include a Town Lake amphitheatre with a venue for waterfront events and a new Town Lake Rowing Center.) Funds for desired amenities, such as a pedestrian trail along Waller Creek, must be raised separately. One likely source of revenues would be parkland-dedication fees on nearby mixed-use/condo projects.

"It is my hope and expectation that the costs of the trail improvements will be covered by parkland-dedication fees," said Cole. Yet the Downtown Commission, at its last meeting, moved to exempt all Downtown residential projects from the expanded parkland fees – another example of city entities working at cross purposes. Should the future condo-cafe projects on a future Waller Creek Riverwalk include any affordable housing – thus winning, in theory, a 100% exemption from all parkland-dedication fees – those condos won't help pay for a Waller Creek trail (though their Web sites surely will market the trail to condo buyers as another Austin lifestyle amenity). What a tangled urban web we weave.

Help Wanted at Rainey Street: Civic-minded master developer

Remember that Town Lake amphitheatre in the Waller Creek tunnel project? It's to be sited where Waller Creek flows into Town Lake, just south of the Convention Center. Interestingly, the tracts of land on either side of that soon to be vastly improved outlet were offered up for sale last Friday by development partners Robert Knight and Perry Lorenz (both also serve on the Downtown Commission), as part of 13 acres they are making available in the historically residential Rainey Street area. In 2005, after years of heated debate, the entire area of more than 20 acres was rezoned Central Business District to allow for high-density development.

The sellers' intent is to attract a private master developer to create a nationally exemplary mixed-use urban development. In terms of public benefits, such a scenario could be exciting for the city – if the master developer is public-spirited. The city of Austin and all of Downtown potentially would have much to gain by attracting a developer with a strong track record of civic-mindedness, one committed to giving back to the community. Even with CBD zoning, additional upzoning requests are highly likely; a planned master development could offer a tremendous opportunity – ã la Mueller – for the city to negotiate significant "density bonus" public benefits, perhaps even as a project partner. (In much of the area, 5% affordable-housing units already are required.)

"There are clearly many benefits to having a master developer for something like this," said Brewster McCracken, "so that every project isn't done piecemeal." While the city is not now directly involved, he said, "We definitely have skin in the game in the success of a development there."

Lorenz explained, "We want to make sure that it's a dense, mixed-use, pedestrian-oriented community, with lots of residential. It's the direction the city is headed, and it's the direction we want to see this go." He said he and Knight "absolutely" would give strong preference to a buyer who shared that vision; they're already talking to master developers nationally with "the experience and the patience for this kind of project." Lorenz said he would expect to stay involved with an out-of-town master developer: "I'm personally very interested in seeing the design guidelines applied."

Most residents of the area now are interested in selling their properties, said Lorenz. For longtime, low-income residents, the upzoning of their homes represents a once-in-a-lifetime financial opportunity. A property worth $70,000 five years ago now could be worth more than half a million dollars, he said – if residents can work together to assemble home sites into larger tracts, which have far more value for development.

"Most of the landowners are interested in getting the best price they can get for their property," said Lorenz. "And they realize they need to work together to get there. They are willing sellers, expecting us to work on their behalf." Lorenz said he and Knight own more than half of the 13 acres they're offering for redevelopment, with the rest still in individual hands; Knight Real Estate Corp. signs dot yards throughout the neighborhood.

But much work, consensus building, and skillful negotiation still would need to be done to bring the whole Rainey Street area into a single master development. Admitted Lorenz, "It doesn't quite have a bow around it yet."

Affordable Housing: A $1 million ante

Constructive Ventures, the developer of the 250-unit Barton Place condominium project on Barton Springs Road, has offered to give a groundbreaking $1 million for affordable housing in the surrounding Zilker neighborhood. The offer represents a significant raising of the bar for contributions by developers; recently, affordable-housing contributions (in voluntary exchange for zoning upgrades to allow extra density) by Central Austin condo developments – including Gables Park Plaza, a T. Stacy & Associates condo tower off Congress Avenue, and the CLB condo tower on West Seventh – have been running $250,000. A Constructive Ventures spokesperson said that the Downtown Spring condominiums high-rise (developed by Perry Lorenz, Larry Warshaw, Robert Barnstone and Diana Zuniga) was the first such project to contribute a total of $250,000 for public benefits (park improvements and affordable housing combined).

The Barton Place affordability proposal, signed between Constructive Ventures (Rick Engel, Larry Warshaw, and Perry Lorenz – again) and the Zilker Neighborhood Association, was submitted at the March 27 meeting of the Planning Commission, which gave its unanimous 9-0 support to the project's rezoning request (with 75-foot height limit and conditions of neighborhood agreement) and passed it up to council. The large contribution is notable because Barton Place is requesting upzoning to add a mere 15 feet; in exchange, it is restricting future development on the front portion of the property along Barton Springs Road's restaurant row to preserve the amenity of neighborhood restaurants. Constructive Ventures presented the deal as an even swap in entitlements, which simply moves buildable area from the front of the site to the back. Even the notoriously difficult to satisfy Jeff Jack of ZNA gave his approval to the project. "We worked very hard for that," said Warshaw.

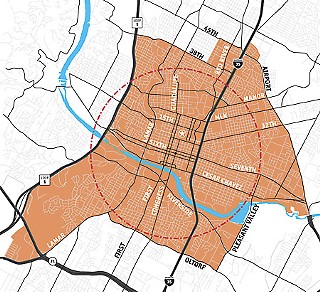

In return for the $1 million contribution, the developers are asking the city for $300,000 in fee waivers or in-kind city services. Alternatively, if the value of the city waivers and services is just $100,000, the affordable-housing contribution will be just $500,000. The city also would provide expedited reviews and permits per SMART Housing program timelines. The developer contributions would be paid into a city trust fund (such as the proposed Downtown Affordable Housing Fund, which would apply to Zilker; see map above). The monies would be spent within the Zilker neighborhood, with approval by ZNA, to provide housing for families at or below 60% area median family income. Currently that's $42,650 for a four-person household. Reaching such families represents significant affordability in fast-gentrifying Zilker: In the Zilker Neighborhood Planning Area, the MFI is $51,201 for family households of two or more, based on the 2000 census.

The Barton Place project behind Austin Java and Uncle Billy's restaurants on Barton Springs Road will include about 250 units in six stories, atop two levels of parking. Early price estimates on the units were $250,000 to $500,000; however, those prices could change, as the project is not scheduled to break ground until 2008. As other public benefits, the developers will preserve many mature native pecan trees and spend more than $250,000 to transplant trees to neighboring city parkland. A dedicated public access through the private property will provide improved neighborhood access to the Town Lake Trail. The development of the 4.3-acre site will replace Shady Grove RV Park, which houses about 40 people in trailers – the quintessential old South Austin affordable housing.

Mueller: Is the middle disappearing?

Entry-level urban living – new units less than $200,000 – is emerging as a great underserved need in the market. New condo projects such as Spring, which initially promised such units, have raised their prices due to recent rapid increases in construction costs. At Mueller – a 711-acre site being privately redeveloped by Catellus, with a big investment by the city of Austin – market-rate single-family homes originally were estimated to start at $180,000. But the least expensive homes now are estimated in the low $240,000s – a price increase of one-third. What happened?

A Mueller representative said that the initial "Pioneer Program" has involved a learning curve for everyone; the price ranges released early on (a tad prematurely) were optimistic estimates that since have proved to be significantly off the mark. Builders still are finalizing home designs, square footage, and finishes – on which prices are based – in the face of rising construction costs. Mueller homes are in presales; after April 30, firm pricing for the 340 Phase I homes will be announced.

For the affordable-housing program, for which 25% of homes are reserved, homes still are priced from the $120,000s to the $160,000s – making them an even better value for households below 80% MFI. However, to discourage "flipping" and to protect long-term Mueller affordability, deed restrictions on affordable-program homes would require profit-sharing, if buyers resell their homes within a few years. The portion of profits owed to the developer would be directly reinvested into more affordable Mueller housing.

As a public-private project, Mueller has a strong stake in serving the public good. Developer Catellus says it recognizes the need to fill the "moderate gap" between the affordable-program homes and the market-rate homes, which are priced up to the $600,000s, according to a representative. They hope to offer more pricing diversity in future phases by including additional home styles, home builders, and possible home-buyer assistance.

Soul Development

Big developers motivated by a sense of social mission do exist. One great example is Jair Lynch, who was brought to Austin last fall as part of the PeopleFund Speaker Series. The Jair Lynch Companies in Washington, D.C., (www.jairlynch.com) are both for-profit and mission-based; its portfolio includes numerous successful urban-redevelopment projects in D.C. designed "to revitalize and create healthy neighborhoods holistically by creating live/work/play/learn environments in which communities can stand and grow on their own." Says Lynch Companies, "We create 'whole' neighborhoods that are socially, economically, and racially diverse, with places to live, work, play, and learn."

"How do you honor the soul of a place?" is a lead question on the Jair Lynch Web site. Austin would do well to ask that same question – and require a stellar response – of every developer reshaping the city in which we live.

To comment on related issues in an online forum or to send a letter to the editor, open this article online at austinchronicle.com.

*Oops! The following correction ran in our April 13, 2007 issue: In the "Affordable Housing: A $1 million ante" section of last week's "Developing Stories: Private Projects, Public Benefits," Constructive Ventures was incorrectly identified as the developer of the Downtown Spring condominiums. In fact, Spring Austin Partners is the name of the group developing Spring. In addition to Perry Lorenz and Larry Warshaw, the partners include Robert Barnstone and Diana Zuniga.

Got something to say on the subject? Send a letter to the editor.